Years ago, I listened to the futurist Watts Wacker Jr. describe the results of his study of 300 companies that had been in business anywhere from 150 to 600 years. The analysis by Wacker, who died in 2017 at age 64, gave rise to a 500-year business plan for some of his clients. What a concept – especially when applied to strategic planning. Instead of planning for one or three or five years, what if companies developed even a 100-year plan? How would we change our thinking about the future? Would we rethink our business metrics? Would we revise our definition of success? Finally, what lessons could we apply to our short-term planning?

In Wacker’s study, all the companies in business for more than 150 years had three conditions in common:

Access to capital

Great understanding of all stakeholders

(shareholders, employees, customers, media, government)

Tolerance for diversity

One other surprising observation from Wacker’s work was that none of the firms made their principal source of revenue from their original line of business. These companies survived because they changed their models by anticipating shifts in the drivers of their business.

So, how do we develop a more thorough understanding of the external environment? What is the role of forecasting, futures research, and scenario modeling? What kind of framework would help us envision the future? All these questions need to be explored in detail for a given firm.

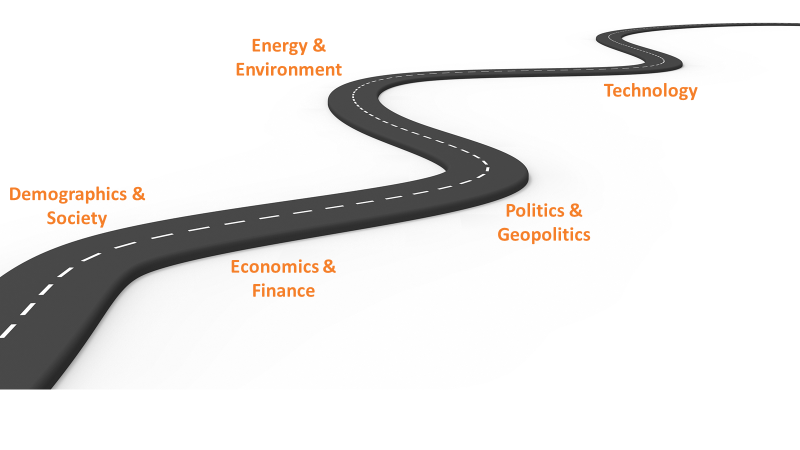

The first step is to develop a good understanding of the external environment – essentially, a framework for envisioning the future. The one I use is based on constant monitoring and evaluation of the set of business drivers shown in the graphic below. These drivers are based, in part, on the seminal work of futurist Peter Schwartz in his book “The Art of the Long View.”[1] Schwartz pioneered an innovative approach for scenario planning and led the efforts for Royal Dutch Shell in the early to mid-1980s. These efforts guided the development of the discipline for futurists and scenario planners that we see today.

The drivers in the chart are grouped for topics that naturally go together:

Demographics & Society: Demographic trends affect investment and spending in market sectors such as infrastructure and medical care; while societal trends affect sectors such as consumer spending and retail investment.

Economics & Finance: These drivers are used together because of the interrelationships between macroeconomics and financial markets.

Politics & Geopolitics: Politics affect most businesses through regulation, taxes, and government investment. Public policies intertwine with geopolitics when geographic and political factors affect the business climate.

Energy & Environment: Energy and environment are intertwined across most industries as cause and effect drivers (e.g., natural resources).

Technology: The exponential growth of technological change has been affecting virtually all market sectors in different ways. What is new for business is the interplay of technology and the other drivers (for example, the effect of artificial intelligence and robotics on microeconomic and macroeconomic conditions).

Setting up a framework of relevant market drivers helps a strategist keep a balanced perspective when sifting through vast amounts of information. This type of framework allows an analyst to identify the important events and more easily dismiss other information as “background noise.”

We have always had uncertainty when looking to the future. However, since exponential growth in technology is compounding uncertainty, perhaps we should focus how our business models should evolve with the dynamics of these key market drivers. A forward-thinking discipline to continually evaluate your business model will help in both the short-term and the long-term.

Can your firm last for the next 100 years?

As always, I encourage your feedback and would enjoy your ideas on the following two questions:

What firms can you think of that have been in business for at least 100 years (without being acquired, though mergers can be included)?

What other drivers do you find useful to follow in your business?

Notes:

- Schwartz, Peter. The Art of the Long View. Doubleday, 1991. ↑